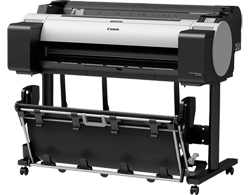

Canon imagePROGRAF TM-300 - 36" (A0) with Stand & Basket

Canon

THIS PRINTER IS DISCONTINUED

CLICK HERE FOR NEW MODEL

- Code:

- 3058C003AA

Description

Description

Canon imagePROGRAF TM-300 - 36" Printer (with Stand & Basket)

The imagePROGRAF TM-300 is 60% quieter and can unobtrusively fit into any working environment. Even on plain paper, the full pigment Lucia TD ink system produces exceptional print quality, and continuous printing boosts output productivity.

|

Full pigmentHigh precision printing for CAD and posters from Canon’s unique 5-colour Lucia TD ink system. |

|

Print fasterBoost productivity by printing faster, thanks to a 6-channel optimised 1.07-inch print head. |

||

Quiet operationPerfect for smaller offices – reduced vibrations and smoother processes make 60% less noise. |

||

Compact designSmall footprint and front usability allows the imagePROGRAF TM-305 to fit flat to the wall. |

||

Software suiteDirect Print & Share, PosterArtist Lite and Free Layout Plus support CAD and poster production. |

Product Specifications |

||

|

Print speed 144 pph (A1) |

Ink type Lucia TD 5-colour pigment ink |

|

|

Operation panel 3.0-inch LCD colour touch screen |

Print technology Thermal Inkjet |

|

|

Max print resolution 2400×1200 dpi |

Compact body 1289 x 887 x 1060 mm |

|

|

Ink capacity 300 ml and 130 ml |

Media thickness 0.07~0.8mm |

|

Watch this Video

Specification

|

Technology |

|

|

|

Printer Type |

5 Colour 36"/914mm |

|

|

Print Technology |

Canon Bubblejet on Demand 6 colours integrated type (6 chips per print head x 1 print head) |

|

|

Print Resolution |

2,400 x 1,200 dpi |

|

|

Number of Nozzles |

15,360 nozzles (MBK 5,120 nozzles, Other Colours 2,560 nozzles each) |

|

|

Line Accuracy |

±0.1% or less |

|

|

Nozzle Pitch |

1,200 dpi (2 lines) |

|

|

Ink Droplet |

minimum 5 pl per colour |

|

|

Ink Capacity |

Sales Ink: 130ml/300ml |

|

|

Ink Type |

Pigment inks - Black, Matte Black, Cyan, Magenta, Yellow |

|

|

OS Compatibility |

Microsoft Windows 32 Bit: Windows 7, 8.1, 10 |

|

|

Print Language |

SG Raster (Swift Graphic Raster), HP-GL/2, HP RTL, JPEG (Ver. JFIF 1.02) |

|

|

Standard Interface |

USB B Port: Built-in Hi-Speed USB |

|

|

Memory |

|

|

|

Standard Memory |

2 GB |

|

|

Minimum Droplet Size |

3.5 pl, With Variable-Sized Droplet Technology |

|

|

Hard Drive |

N/A |

|

|

Printing Speed |

|

|

|

CAD Drawings |

0:40 (Fast Economy Mode) |

|

|

Poster |

0:44 (Fast) |

|

|

Coated Paper (A0 Page Size) |

1:41 (Fast) |

|

| Media Handling |

|

|

| Media Feed and Output |

Roll paper: One Roll, Uppper-loading, Front Output |

|

|

Media Width |

Roll paper: 203.2 - 917 mm |

|

|

Media Thickness |

Roll/Cut: 0.07 - 0.8 mm |

|

|

Minimum Printable Lengh |

Roll paper: 203.2 mm |

|

|

Maximum Printable Lengh |

Roll paper: 18 m (Varies according to the OS and application) |

|

|

Maximum Media Roll Diameter |

150 mm

|

|

|

Media Core Size |

Internal diameter of roll core: 2"/3" |

|

|

Margins Recommended Area |

Roll paper: Top: 20 mm, Bottom: 3 mm, Side: 3 mm |

|

|

Margins Printable Area |

Roll paper: Top: 3 mm, Bottom: 3 mm, Side: 3 mm |

|

|

Media Feed Capacity |

Manually switchable by user |

|

|

Borderless Printing Width |

515mm(JIS B2), 728mm(BIS B1), 594mm(ISO A1), 841mm(ISO A0),10",14",17",24",36" |

|

|

Max number of delivered prints |

Standard position: 1 sheet |

|

|

Dimensions & Weight |

|

|

|

Printer Dimensions |

Main Unit, Stand and Basket |

|

|

|

|

|

|

Power & Operating Requirements |

|

|

|

Power Supply |

AC 100-240V (50-60Hz) |

|

|

Power Consumption |

Operation: 69 W or less |

|

|

Operating Environment |

Temperature: 15-30℃, |

|

|

Noise Level |

Operation: 44 dB (A) (Plain paper, line drawing, standard mode) |

|

|

Regulations |

Europe: CE mark, Russia: EAC |

|

|

Certificates |

TUV, CB |

|

|

What's included |

|

|

|

What's in the box |

Printer, 1 x print head, 3-inch paper core attachment, Power Cable, UK Power cord (240V,3P), 1 set of starter ink tanks, Set up guide, Safety/Standard Environment leaflet User software CD-ROM (Win) PosterArtist Lite CD-ROM, EU Biocide Sheet, Eurasian Economic Union Sheet, Important Information Sheet |

|

|

|

|

|

|

Options |

|

|

|

Optional Items |

Printer Stand: SD-23 |

|

|

Consumables |

|

|

|

User Replacable Items |

Ink Tank: PFl-120 (130ml), PFl-320 (300ml) Print Head: PF-06 Cutter Blade: CT-08 Maintenance Cartridge: MC-31 |

Related Items

Finance Calculator

- * Fixed rates for the duration of agreement

- * Major tax benefits - each payment Is 100% tax deductible

- * The equipment can be earning your next payment from day one

- * No need to have bank loans, overdrafts or pay cash

- * Fast application turnaround

- * Spread the cost of your equipment purchase

- * Protect existing lines of credit and preserve cash flow for business growth

The Tax Benefits of Leasing explained

Leasing converts a large capital expenditure into small monthly payments. Hence the company has the profit-making equipment immediately and keeps their cash reserve available.

Rather than investing the precious cash reserves in depreciating assets, the company can use them to help increase profits.

Lease Rental is 100% Tax deductible

The main reason that the majority of companies lease rather than purchase equipment is that they use leasing as a method of reducing their tax bills. This is because lease rental is 100% tax deductible, and all payments made for the equipment are written off against the company’s tax bill. For any profit making business, this means a substantial saving in the real cost of acquiring equipment by lease rental. This could mean a saving of between 20-40% of the lease payments, depending on the rate of tax you pay.

Payments on qualifying leases are written off as direct operating expenses, rather than a debt or outstanding liability, thus reducing short term taxable income.

Any capital allowances are passed on to you, and lease payments can be offset against taxable profits. VAT can also be reclaimed on monthly payments. This status as a “lease” as opposed to a “liability” on a company’s balance sheet is something the banks like to see, which is why an operating lease can be attractive. For this reason, leasing is often referred to as ‘off balance sheet’ financing – a tremendous advantage to both large and small businesses.

Ownership at the end of the lease

Lease rental is just that, a rental or hire agreement. Title of the goods remains with the Lessor (either Kennet or assigned to a bank), which means the equipment does not show on the companies balance sheet, therefore not needing to be depreciated over a fixed period. If Kennet broker the funding, they are the “third party” involved within the lease agreements. In effect, Kennet buys the equipment from the supplier and then sell it on to the customer. This means that the customer can take full advantage of all the benefits of leasing but still owns it at the end. (Tax loop-hole)

The disadvantage of buying equipment outright

The disadvantage to buying equipment out-right, is that the capital invested becomes a depreciating asset. This is an asset that’s value decreases over time.

The total amount that assets have depreciated by during a reporting period is shown on the cashflow statement, and also makes up part of the expenses shown on the income statement. The amount that assets have depreciated to by the end date is shown on the balance sheet.

Downloads

Related items

Code

Description

Price

Quantity